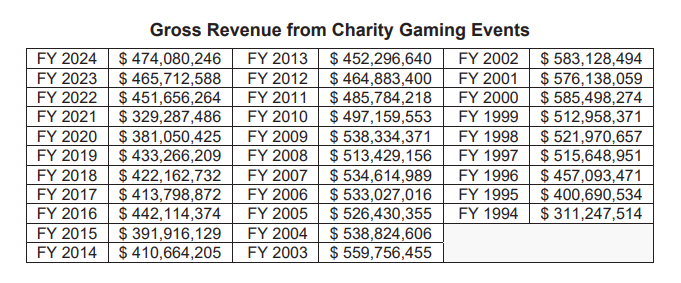

$14.7 billion in Indiana charity gaming revenue in 30 years

As with virtually everything else in the Hoosier economy, the pandemic extracted its toll on charitable gaming revenues in fiscal years 2020 and 2021. The pandemic shutdown ended June 15, 2020, and while casinos bounced back relatively quickly even before vaccines were available due to extensive protocols that included removal of slot machines, table games, and positions at table games to promote social distancing and installation of plexiglass dividers to ensure it, the effective 18-month Covid-19 “aftermath” hampered large charitable gaming venues and other entities offering charitable gaming – such as fraternal and service organizations – who were also subject to largely the same restrictions, but whose target audiences were largely older (and more susceptible to Covid) and more reluctant to venture out before vaccines were widely available.

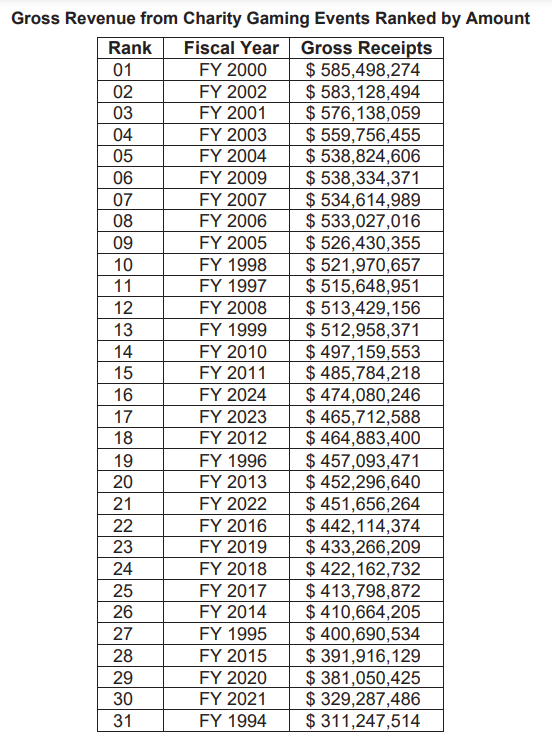

But it appears anyone who bet against charity gaming’s return would have lost as the numbers for the next three years, FY 2022, FY 2023, and FY 2024 returned with a vengeance. Following back-to-back years of decline, charity gaming numbers increase across three straight years for the first time since 1998, which had marked the end of the first five years of charity gaming, and a point when eight of the original 10 riverboat casinos were open (all save the casinos in Harrison County and Switzerland County). The FY 2024 bottom line is at its highest in more than one-dozen years – since FY 2011. FY 2024 revenues grow by $8,367,658 (1.80%) from FY 2023 levels. The bottom line tops $450 million for three straight years for the first time since the run ending in FY 2013.

On the flip side, however, the FY 2024 revenues don’t even land among the top 15 years for charity gaming revenues . . . and barely even squeeze into the top half of revenue for the entire history of charity gaming in Indiana.

Gross revenue from charity gaming events had plunged to $329,287,486.35 during the Covid-affected FY 2021 – the lowest outside of the original partial first year of charity gaming in Indiana – and the fact that the revenues were down by only 13.58% ($51.76 million) over the prior year we suggested was a Hoosier success story of sorts (though with Fiscal Year 2020 numbers down to their lowest level since the debut of charity gaming in the state in 1993 due to the Covid shutdown, that wasn’t, as one former Hoosier governor might have suggested, “a might high hurdle” to mount).

Even so, in real terms, the FY 2021 charity gross gaming receipts were at their lowest amount since the first year such events were legalized, and the revenues were down following two successive years which exhibited gains . . . though, as we’ll elaborate on shortly, direct year-to-year comparisons might not be appropriate because of recent legislative and economic developments.

As with virtually everything else in the Hoosier economy, the pandemic continued to take its toll on charitable gaming revenues in Fiscal Year 2021 (July 1, 2020 – June 30, 2021).

The pandemic shutdown ended June 15, 2020, and you’re well aware that Hoosier casinos bounced back relatively quickly even before vaccines were available due to extensive protocols that included removal of slot machines, table games, and positions at table games to promote social distancing and installation of plexiglass dividers to ensure it and instill patron confidence. However, the effective 18-month Covid-19 “aftermath” hampered large charitable gaming venues and other entities offering charitable gaming – such as fraternal and service organizations – who were also subject to largely the same restrictions, but whose target audiences were largely older (and more susceptible to Covid) and more reluctant to venture out before vaccines were widely available.

But it appears anyone who bet against charity gaming’s return would have lost as Fiscal Year 2022 (July 1, 2021 – June 30, 2022) numbers reflected a strong comeback, and FY 2023 and FY 2024 continued to build upon that healthier bottom line.

FY 2022 gross revenue climbed back to a more robust $451,656,264.14, the strongest numbers in nine years, topping recent pre-Covid performance. The $465,712,588 in FY 2022 charity gaming revenues were up by $14,056,324 (3.11%), showing steady, if not particularly flashy, gains.

Nevertheless, even the (relatively) strong numbers from the past three years pale in comparison to the action we saw from charity gaming in its heyday at the turn of the century. The past three fiscal years have ranked 16th, 17th, and 21st among the 31 years of charity gaming, while the top five years came in FYs 2000-05 (although not sequentially), when the milieu was much more Wild, Wild Midwest (with minimal restrictions on and even less enforcement of both the inflow and outflow of charity gaming dollars).

And, as we told you back then, the Indiana Gaming Commission noted that the FY 2021 and FY 2022 Annual Charity Gaming Reports are “different due to significant legislative changes enacted during the 2019 legislative session,” specifically, referring to HEA 1517-2019 and SEA 393-2019, which both became effective July 1, 2019.

As the commission put it, “The statutory changes simplified the previous licensing scheme by reducing the number of license types while continuing to allow the same gaming activities authorized under the since-repealed IC art. 4-32.2.”

Because of the changes, the reports include a combination of the new and earlier license types . . . and it renders it impossible to reconcile the old-style reporting of individual games and licenses with those beginning in FY 2021.

The commission spells out that “Beginning July 1, 2019, an organization that held one or more type(s) of an annual license could apply for and receive a single Annual Activity License to conduct the distinct types of charitable gaming activities under the same license.”

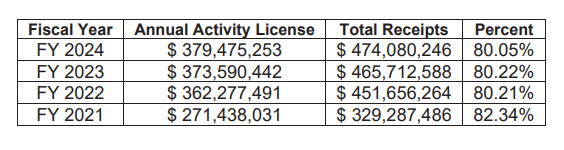

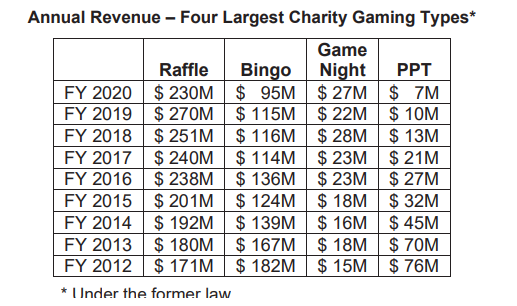

Know that the report’s visage change in FY 2021 and FY 2022 makes it difficult in particular to ascertain which games contributed to the now mammoth annual activity license, which seems to generally account for the generation of some 80% of all charity gaming revenue.

Here is how the gaming breakdown looked in the past several fiscal years leading up to the change, FYI:

In addition, Diane Freeman, the retired, long-time (and founding) director of charity gaming for the Indiana Gaming Commission (and Department of Revenue before that) explained to your favorite gaming newsletter a few years back that new licenses were created by the 2019 legislative changes: “The convention license allows a nonprofit from out of state to come in, in conjunction with a conference or convention to obtain a license to conduct a raffle. There was also a three-year veteran license, which allows the veteran organization to get a license that is valid for a three-year period, but they are still required to file a financial report to us each year and pay their license fee each year.”

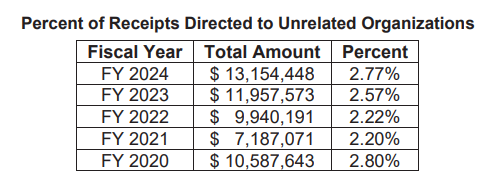

Both the amount and percentage of gross receipts contributed to unrelated charities have grown progressively since FY 2020. Long-time readers should recall that less than two percent of the overall gross was distributed to unrelated charitable entities as recently as FY 2009, under a different set of laws – laws that were specifically changed because a suspicious percentage (and amount) of revenue seemed to be retained for “administrative expenses” by operators, and thus a particularly a low number of dollars were ultimately distributed to unrelated charitable entities.

The best year for both the percentage of and real dollars donated was FY 2005, when 3.08% of proceeds were donated to unrelated entities, a total of $16.2 million.

Seven entities took advantage of the change in state law allowing a parent organization to apply for and receive an “annual comprehensive license” for assorted affiliates, a change strongly advocated before the legislature in recent years, in particular by the National Rifle Association and conservation organizations – effectively the same entities that had lobbied for the streamlining.

During FY 2021, FY 2022, FY 2023, and FY 2024 the only entities operated under annual comprehensive licenses were:

— National Wild Turkey Federation

— Delta Waterfowl

— Pheasants Forever

— Rocky Mountain Elk

— NRA Foundation

— Ducks Unlimited

— Whitetails Unlimited