Relatively strong performance held back by lack of iGaming

Final commercial gaming revenue numbers are in nationally, and the American Gaming Association, which collects the data, also massages it to detail key data by state and region.

Among the 36 commercial gaming jurisdictions that were operational in 2023, 28 – including Indiana – increased combined revenue from land-based casino games, sports betting, and iGaming (the latter an option not available in the Hoosier State).

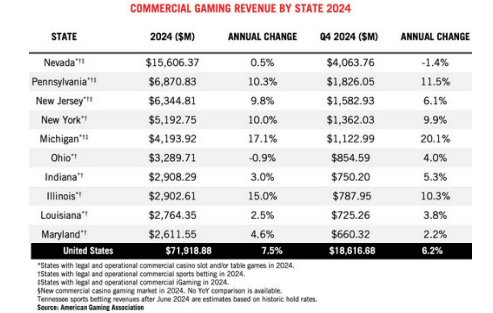

Indiana’s 2024 commercial gaming revenue ranks seventh nationally, but trails our neighbors in Michigan and Ohio . . . and Illinois is hot on our heels, only about $5.68 million behind us – a marginal amount that can be quickly flipped with just one good month for one property in one state, or one bad month for another.

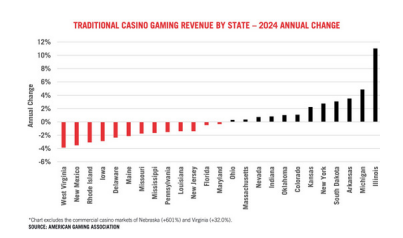

Indiana’s revenue grows by 3.0% over the year (recall that we told you in January that casino win alone was up by only $32.34 million, or 1.8% from 2023), with five of the top 10 states enjoying a higher percentage growth. Traditional casino gaming set an annual record in 13 states, but not Indiana, even as we were one of 14 states growing combined slot and table game revenue compared to 2023.

The Indiana bottom line is, as you might assume, largely constrained by the lack of iGaming.

Even though we have benefited from sports wagering (particularly online), we failed to break into the 10 top sports betting states by revenue in 2024 after a strong start a few years back that landed us consistently among the national leaders until larger states began to adopt sports wagering and outpace us, and business began to be usurped by our adjoining states.

The class of top 10 states in annual sports wagering revenue includes our neighboring states of Illinois (second) and Ohio (fourth).

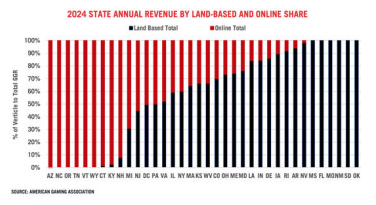

Online gaming (sports and casino) now generates the majority of commercial revenue in 13 states, including our neighbors in Kentucky and Michigan.

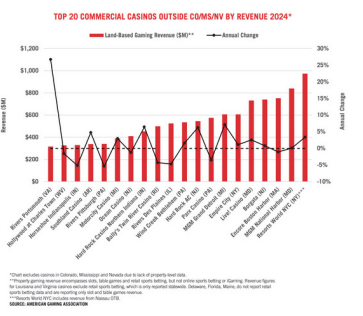

While the lucrative Cincinnati market does not appear among the top 20 commercial casino markets nationally, the third-most lucrative market nationally remains the Chicagoland market that Indiana shares with Illinois.

Only the Las Vegas Strip and Atlantic City areas are better performers – and both of those traditional markets suffered over the year decreases in revenue while the Chicagoland market, boosted in part by the opening of new properties, grew by 2.6% . . . a stronger percentage increase among the top 20 markets than all but Detroit, which itself, as AGA notes, “bounced back from labor disputes at the tail-end of 2023 to generate its highest yearly revenue total since 2019.”

At the individual property level, three of the top 20-performing casinos nationally outside of Colorado, Nevada, and Mississippi are located within the Chicagoland market. While Rivers Casino Des Plaines is the leader among the three, Hard Rock Casino Northern Indiana and Horseshoe Casino Hammond also earn a place in the top 20 nationally.