First quarter of 2024 doesn’t match up to 2023, but . . .

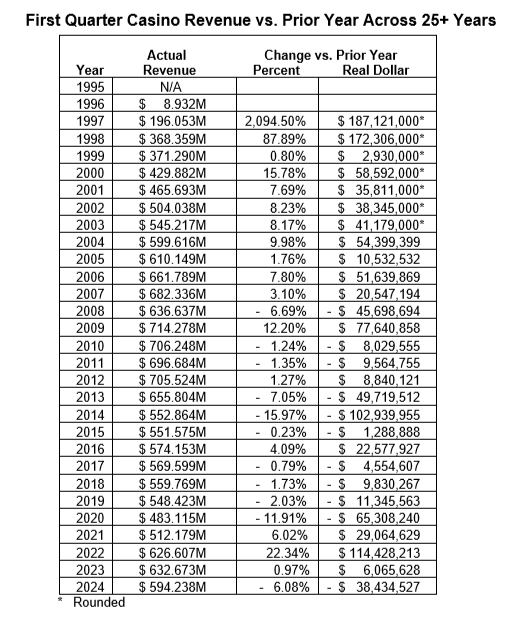

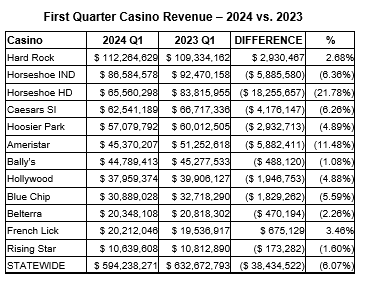

Through the first three months of 2024, statewide win of $594,238,266 at Indiana’s 12 commercial casinos properties is down by $38,434,527 (- 6.08%) from $632,672,793 during the same quarter in 2023. One year after we had marked the first three-year streak of (pandemic-aided) over-the-year growth in first quarter revenues since a foundational run ended in 2007, we’re now turning in the opposite direction. From 2007 until the 2021-23 streak, the casinos had not been able to even muster consecutive year gains in the always-important Q1, and 2017-20 had seen the longest first quarter over-the-year stretch of shortfalls in state history.

Last year was the state’s best first quarter in a decade – since 2013 (the downtown Cincinnati land-based casino debuted early in March of that year) – and had offered hope that the state would be back on track for improved performance, particularly given that the major renovations at Harrah’s Hoosier Park Racing & Casino had ended in December 2023, and the upgrades were fully operational in the first quarter of 2024.

Alas, further improvement was not to be in the cards.

The first two consecutive first quarters of win topped $600 million (and actually exceeded $625 million) for the first time since 2012-13, following the two worst back-to-back first quarters the state had endured since 2001 and 2002, a period when the state was still requiring casino vessels to cruise, and the state had three fewer casinos. Each month of the 2023 first quarter produced the best revenue the state had seen in that month since 2013, except March 2023 numbers, which fail to top those of March 2022. During Q1 2024, however, each month landed south of each corresponding month since 2021, when patrons were going stir-crazy after the pandemic protocols started to be rolled back, and vaccines were becoming more readily available to adult age cohorts.

Speaking of 2013 . . . if the 2019 first quarter had not found itself shortened by two weeks in March due to the pandemic, that quarter would also have likely been the most lucrative since the Ohio casino contingent was complete – and it also likely would have continued a 12-year streak in which February and March showed improvement over the prior month. After 2019 and 2020 failed to maintain that run, we saw the positive trend begin anew in 2022 before reversing again this year.

Why should you be so interested in first quarter numbers?

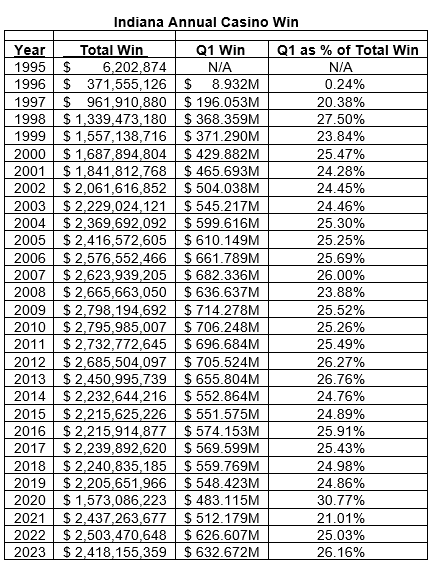

As we gently remind you each April, Q1 is a particularly important quarter – probably the key quarter each year – for Indiana’s gaming properties.

Casinos in the Midwest region have traditionally expected to post their top revenue quarter of the year in the January – March period – assuming weather does not trend significantly worse than the norm. While weather played a negative part in the 2024 first quarter, particularly with lengthy snow emergencies in LaPorte County and to a lesser extent in Lake County, weather is frequently a factor in Q1 revenues – and usually to the detriment of revenues (remember everyone cursing Mother Nature back in 2004 and again in 2014?). At least that had been conventional wisdom among casino general managers until at least five years ago. But given interviews with casino general managers in the mainstream media concerning March revenue in 2022 and again in 2023, we know that old rule of thumb seems to have returned as part of Hoosier conventional wisdom.

Note as well that the quarter may gain a day’s worth of revenue in a year in which February has 29 days (such as we enjoyed in 2024), and can also be affected by the number of weekend days in the quarter and where the New Year’s Day holiday falls in the week.

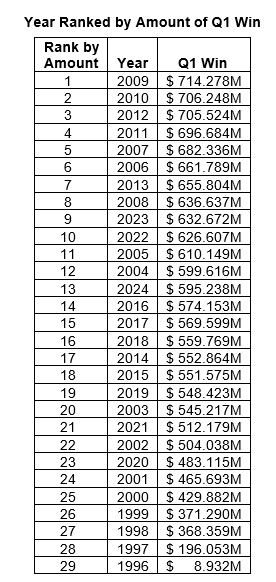

Here is how Q1 casino win has ranked across history (note that we didn’t round out our “full” 10-boat compliment of casinos until the first quarter of 2001):

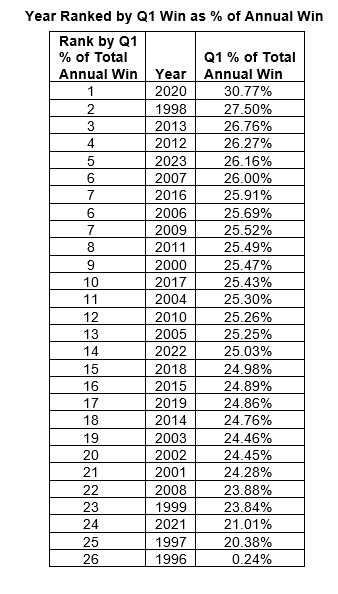

And if you’re interested as to how each year fared ranked by how first quarter win fueled total annual win, this table should help sate that curiosity. Note that as recently as 2020, first quarter win accounted for almost one-third of the entire annual win thanks to the numbers being skewed by Covid, while the following year served up the lowest contribution of Q1 to the entire year (for a year in which at least 10 casinos were active all year), also due to the phase-out of Covid protocols later in that year.

Some of the quarters (and years) may also have been impacted by Covid closures, the emergence from the lockdown, and ultimately the widespread availability of the Covid vaccine and complete repeal of Covid protocols.

March 2024 was also aided by the $42.6 million in revenue collected at Hard Rock, a record for any casino in any month for Gary.

After the first quarter of 2016 interrupted a depressing three-year losing streak (2016 was also the last time in which all three months of Q1 saw growth over the corresponding month in the prior year), 2017 results took a step back, 2018 dipped further, and (despite a new land-based option and live dealers at the racinos) 2019 took an even longer stride backward – and then Covid-19 shuttered the casinos for the 2020 first quarter as of March 16, ensuring that the rebound trajectory would not be sustained. While Q1 2019 was flat-out lousy, it still stands out as better than the subsequent two first quarters due to the exigent circumstances.

While the January – March 2015 period marked the first time since 2003 in which none of the months in the first quarter hit $200 million, we managed to cross the $200 million Rubicon again in March 2016, and sustained that one-month March trend in each first quarter since – until the Covid-caused shutdown in March 2020 interrupted the streak, only to be resumed in 2021, despite the persistent pandemic problems (even though it was the lowest full month of March since 2017). March 2022 win of $235 million put an exclamation point on March (and the first quarter) making an emphatic return to normal, and while March 2023 and 2024 numbers failed to sustain the over-the-year growth, the months of January and February were able to boost the Q1 numbers above the comparables for the past several years – until 2024.

Looking back even a decade before the pandemic – from the first full year of the financial crisis in 2009 through the Covid-truncated Q1 of 2020 – nine of the 12 first quarters experienced revenue declines from the prior-year quarter. As we’ve noted above, we then experienced a trio of successive Q1s with growth in win over the prior year . . . a phenomenon that we had not enjoyed since 2007 (and before then, we had not seen any Q1 over-the-year decline), but did not last through the first three months of 2024.

When you add up the actual Q1 revenue over the same prior-year quarters, the amount tallied across the past three first quarters is the highest of any three-year growth period since 2013, but some of that is wind-aided, thanks to comparisons with pandemic shutdowns and post-pandemic restrictions.

By comparison, 16 years ago during the first quarter of 2009 – a period theoretically depressed by the impact of the global fiscal crisis – January through March win of $714,277,954 that year was not only a record for the quarter in Indiana history, but also $165.86 million (23.22%) more than during the first quarter of 2019. But that 2009 first quarter didn’t include competition from some 45,000 Illinois video gaming terminals and a shiny new casino in Des Plaines and a facility in downtown Chicago, four land-based casinos and seven racinos in Ohio, historical horse wagering machines in Kentucky, and a land-based Native American casino in South Bend – nor competition from sports wagering in Indiana and our neighboring states.

In contrast to the record first quarter revenue of $714.278 million earned in 2009, Q1 revenue is down by $120.04 million in 2024, a 16.81% reduction from the apogee.

At this juncture back in 2015, we opined that “The state’s failure to make a first quarter recovery is far more problematic than most people realize, particularly as it seems to result from a combination of tough to resolve factors.”

As we told you nine years ago, we likely won’t find ourselves recovering to such lofty levels given the rise of competition around us and economic considerations (there are only so many discretionary dollars that Hoosiers and our neighbors have to spend on gambling when there are so many other entertainment options . . . and prices rise for everyday goods and services), although the performance of Gary’s Hard Rock Casino Northern Indiana, major expansions in Shelbyville and Anderson, other property improvements, further moves off actual boats and from bodies of water, and the Vigo County casino could help draw us incrementally closer to the glory days of gaming in the Hoosier State.

But recall that we’re now competing against Chicagoland’s top (and recently expanded) casino, Rivers Casino, which wasn’t in operation until 2011; some 45,000 VLTs in Illinois that didn’t debut until a decade ago; a casino in Danville, Illinois, just across the state line on I-70 (and sited within a chip’s throw of legal recreational cannabis dispensaries) the four land-based casinos and multiple racinos in Ohio; historical horse racing machines close by in Louisville, Ellis Park, and Greater Northern Kentucky; and the Four Winds Casino in South Bend that now offers live table games. Coming soon(ish): new south side and a permanent West Loop casinos in Chicagoland.

The competitive life (and economic environment) is decidedly different than it was just 10 or 12 years ago, and even the bounce we enjoyed from retail and mobile sports wagering has been eroded by market creep in Illinois, an entire new industry in Ohio, and a hit from sports wagering landing in Kentucky, where historical horse racing machines are also having an impact across the entire Ohio River contingent of Hoosier casino properties.

Two years ago, as we had emerged from the cloud of Covid, we demonstrated to you that most of the Indiana casino properties turned in their respective best first quarters in either 2013 or 2022, with a few outliers.

Four casinos, Ameristar Casino East Chicago, Belterra Casino Resort, Blue Chip Casino, and Horseshoe Casino Hammond have turned in their lowest Q1 numbers in 2024 as Hard Rock continues to dominate the Lake Michigan properties, Rivers Casino continues to serve as the Chicagoland leader, and the new Bally’s Chicago temporary facility improves, perhaps also helping to incrementally chip into some of the Northwest Indiana numbers. This was also the first full quarter during which the new hotel tower at Four Winds Casino South Bend was open for the full first quarter.

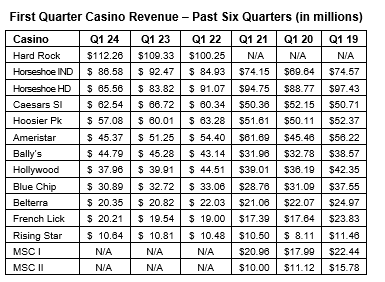

And here is how each casino has performed across the past six first quarters: