Strong launch for Terre Haute casino in short, hotel-free

The first set of revenue numbers are in for the Terre Haute Casino Resort, and it is the solemn duty of your favorite gaming newsletter to analyze them in all kinds of contorted contexts to give you an idea as to how the property has measured up to expectations, where it seems to be fitting in with respect to the other properties, the impact it has had on other casinos within the state, and what to expect going forward.

And, of course, we can do all of this simply by evaluating 25 days of operation in a generally slow month (which should have you asking why we can’t provide you with next week’s winning Powerball numbers).

So, yeah, we’re going to be basing a lot of speculation on just 25 days’ worth of business, the early days featuring both pent-up demand and the usual curiosity in the local market, as well as a month in which all 12 weekend days fall within the 25 days of operation. And did we mention that the hotel and assorted other amenities weren’t even available to patrons until May 15?

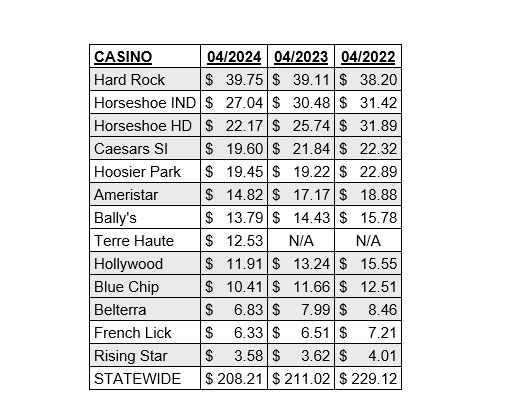

That said . . . the new Churchill Downs Inc. Vigo County facility appears to be off to a strong start, generating revenue of $12,525,199 in its (Friday) April 5 – April 30 debut. If you merely extrapolate those numbers to the full 30 days (and do not account for the traditional bump from the grand opening or the additional five days that were not weekend days), that would work out to about spot-on $15 million for April, or – if you throw in some of the valid adjustments, a figure that would effectively place the new casino right about in the middle of the state pack, but clearly well up into the second tier in terms of win.

We checked in with some who had submitted proposals at various stages of the Terre Haute licensing process and had been told by one to expect the property to attract somewhere slightly south of 75% of Bally’s Evansville revenue once fully ramped up, while another suggested that their initial projections seem to be matching the (presumably adjusted) early numbers . . . so those who have been following things are not particularly surprised.

What is obvious is that Terre Haute will outperform the $100 million Danville, Illinois property which opened on May 27, 2023 and brought in only $365,864 in its first four days, and then only $2,083,669 more in June at a property effectively built to market, unlike the $290 million Terre Haute complex.

During April, the Golden Nugget Danville posted revenue of $2,895,307, less than one-quarter of the April Terre Haute revenue.

What we don’t know: just how much market share Terre Haute snagged from Danville, one hour north on U.S. 41 at I-74, because we have no over-the-year comparison from the Danville entry. In case you’re curious, here is how the Golden Nugget performed leading up to April:

March $5,493,863

February $3,725,182

January $2,806,609

The new Vigo County property appears to be hitting on all cylinders in its early performance, but we’re not sure how sustainable this will be. A casino always gets a bump from its grand opening, and it should also enjoy an additional increment with this week’s opening of the hotel and other restaurants and lounges, skewing May numbers as well (May should also bring a heavy volume of Indianapolis 500 race traffic from Illinois through Terre Haute on I-70).

How does THCR appear to be performing compared to the other state properties? If our April extrapolation is accurate, this property should be slotting in midway through the pack, and may effectively be right at the same level as Bally’s Evansville after traffic regularizes, the local tire-kickers move along, and the rewards club membership marketing kicks in.

One thing we’ve noticed over the years has been that, absent some special problem (generally flooding or a major road or bridge closure), there is very little month-to-month volatility in casino rankings statewide, and almost no such movement on an annual basis. We’re looking for Bally’s and Churchill to duke it out each month, and we’ll be interested to see if the early numbers that might suggest a Churchill edge are sustainable.

What impact has Terre Haute had on other casinos within the state? We can’t discern any early significant incursion on the market share of potentially competing properties, and see just a marginal improvement in overall southern market size – a larger bump than might be typical, but not enough to raise eyebrows.

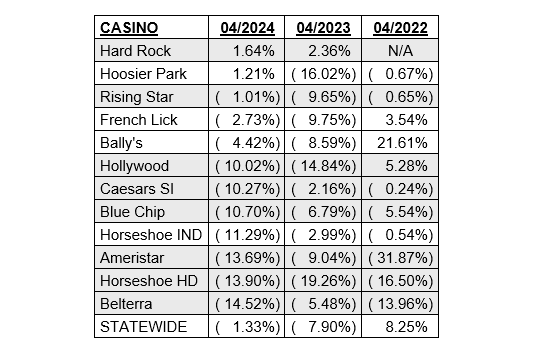

If you parse the following table, you’ll see that we’ve grayed out the casinos against which Terre Haute arguably does not directly (and we’re perhaps stretching a shade to include the two Central Indiana racinos), retaining them only to show you that only one of these seven casinos – the juggernaut that is Hard Rock Casino Northern Indiana – improved revenue from April 2022 to April 2023.

Among the four properties with which the Terre Haute Casino Resort effectively competes, three saw revenue declines over the prior year, but that is no different from what you see at the other properties that should not be impacted by the new competitor. And when you look back to April 2023, all four had experienced April-to-April revenue shortfalls in the prior year, making what you see in April 2024 unremarkable. Absent running a regression analysis (on extremely limited data that wouldn’t prove anything, anyway), it appears as though no individual property appears to have been unduly impacted.

Some of that could change, however, now that the new hotel has opened (as of Wednesday). Casino General Manager Mike Rich tells WTHI-TV in Terre Haute, “I think this will really help us propel the people who live an hour-and-a-half plus from us. They want a chance to stay overnight, and I think we will be able to take a lot of those visitations that currently go to French Lick or Evansville – and have them come to us.”

Note that in the following table, the properties which suffered the largest over-the-year percentage decline in revenue largely account for more than the bottom half of the table, and all but one are outside the Terre Haute market area. The smaller losses came from properties within the THCR range . . . and when you look back at the shortfalls posted between April 2022 and April 2023, there isn’t much individual or collective difference.

We’d venture to suggest that the new casino might even be responsible for growing the market, but one month – particularly the month of April – does not offer sufficient evidence for such a conclusion. However, same-unit revenue from the TH market area in 2024 was $66.61 million vs. $70.64 million in April 2023, so excluding Terre Haute from the April 2024 revenue column in this region, the market is down by $4.03 million (- 5.70%) . . . but the April 2022 revenue from these same properties had been $77.30 million, so April revenue has been ticking down.

When you add in the April Terre Haute revenue, the five properties account for $79.14 million in win, so the new casino is seemingly growing the market (we’re excluding the Golden Nugget Danville here) by some 12% from April 2023 and by more than two percent over April 2022 – at unadjusted April 2024 Terre Haute levels.

Some two decades ago, when a new riverboat would open in a relatively competitive market, we were seeing markets grow by some 20%, but we’re in a different economy today, and not only do we have different entertainment options to compete against that were unavailable in the early 2000s, (think, e.g., streaming television services), but there is also intramural gaming competition at play, including shiny new land-based casinos in more markets; sports wagering; and (ostensibly illegal in Indiana, but . . . ) overseas iGaming sites.

What should you expect from the Terre Haute Casino Resort going forward? Again, probably solid revenues that more largely resemble Bally’s Evansville than any other property, and minimal cannibalization of other casinos (if Terre Haute didn’t seem to carve out any business from French Lick Resort Casino in a non-resort month of April, it’s hard to see that it will have a significant impact in the fun-filled summer months).

Projections of $106 million in annual Terre Haute casino revenue from the 2019 impact study for the Casino Association of Indiana by The Innovation Group appear to be low, but the assumptions may have been considerably different five years ago. In December 2021, we told you that the estimated adjusted gross revenue by applicant for the four then-applicants varied by

almost 50% from top to bottom. Premier Gaming Group at just $104.30 million and Hard Rock International ($104.47 million) were tightly clustered at the bottom, followed by Churchill ($119.66 million), and led by Full House Resorts Inc.’s $152.15 million projection.

For purposes of comparison, we’ll note that Bally’s Evansville posted AGR of $172.81 million in 2023 and $176.63 million in 2022.