Win down over the year despite TH addition, HP renovation

Until the pandemic hit in 2020, we had traditionally brought you a July deep dive into the mid-year casino numbers, detailing how things had progressed through the first half of the year and serving up our (modestly speaking!) virtually spot-on predictions for where the bottom line would finish at the end of December. That custom came to an abrupt halt after three full months of pandemic-forced closures rendered the first-half numbers meaningless in any context, and the total uncertainty cast aside the thought that any projections could be meaningful.

The following year we rejiggered things and at least tried to present the first-half figures within historical context, if not taking too big a leap to project (using our secret recipe) how we presumed the year would end. As we seemed to have settled into a “new normal” of sorts, we reprised at least some of the tradition and offered you some perspective on the first-half 2023 numbers . . . but as the calendar turned to 2024, we were confronted with the newly renovated Harrah’s Hoosier Park Racing & Casino impacting numbers for the first few months, and then the mid-April debut of the Terre Haute Casino Resort and mid-May entry of its hotel into the market shaking things up again, making it difficult to compare results against January – June 2023 and draw strong conclusions for the remainder of 2024. But, hey – why should that stop us from trying?!

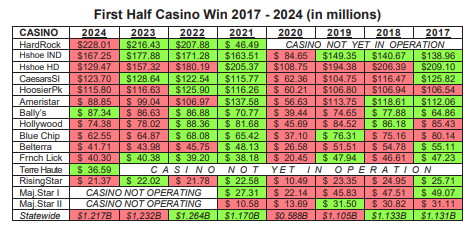

Indiana commercial casino win of $1,217,326,240 for the first six months of 2024 lags the $1,231,853,796 collected during January – June 2023 by 1.18%, and the $1,264,817,710 the commercial casinos reaped in January – June 2022 despite the addition of almost a full quarter’s revenue from a mid-pack-performer that did not exist one year earlier.

The January – June 2023 numbers had served as the second-strongest win for the first half of any year since 2013 (trailing only the first half of 2022), when the fourth Ohio land-based casino debuted in downtown Cincinnati (and the first time we had competed against the video gaming terminals in Illinois for any January – June period). The current run of first-half numbers is now the third-best win in the past decade+, but still raises question about why they are not stronger given the new and renovated properties.

Indeed, with the obvious exception of the pandemic first half of 2020, this represents only the third over-the-year decline for first half numbers since 2014 . . . but the second consecutive decline, which is obviously a troubling trend.

The 13 properties report an 4.03% increase in semi-annual revenue compared to the Covid recovery period in 2021, and a 106.97% improvement over the 13-property 2020 period (the two Majestic Star Casino properties were effectively traded for the Terre Haute casino and Hard Rock Casino Northern Indiana), which, of course, was effectively just one quarter instead of two as casinos were dark from March 16 – June 15, 2020.

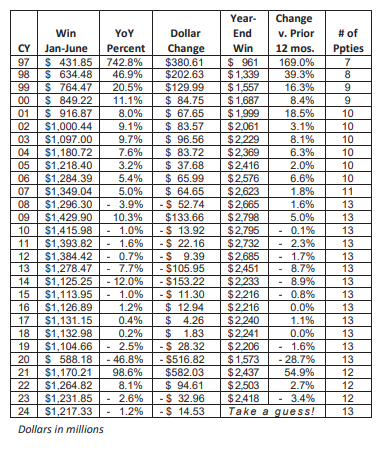

Here is how the first two quarters in previous years contributed to the final results for the full years:

Looking back to the final pre-pandemic period, the first two quarters of 2022 generated almost 12% more revenue than in the same period of 2019, which itself had been impacted by nasty weather that forced some casino closures, as well as strong competition from Ohio. Indeed, the 2018-19 first half had seen the first downturn in January-June results since 2015. For the six months ending June 30, 2019, statewide casino win amounted to just $1.10 billion, a 14-year low . . . until the pandemic hit.

Only two of the 12 same-store properties grew win from the first half of 2023 to the first half of 2024, Hard Rock Casino Northern Indiana and Bally’s Evansville. Five of the 12 casinos reported 2023 revenue growth (vs. seven of the 11 that were open for all of the six months of 2021 and 2022 reporting growth from 2021 to 2022).

Ten properties saw revenue fall from the first six months of 2023 to the same period in 2024, while seven properties lost traction from the first half of 2022 compared to the first half of 2023.

Only four properties showed improvement from the five-year-old 2019 January – June numbers, and two of those are effectively wind-aided (the Anderson and Shelbyville properties, which were bereft of table games in 2018). Caesars Southern Indiana and Bally’s Evansville, both of which moved to land-based platforms, also grew revenue from the last year before Covid.

In 2022, if you excluded Majestic Star Casino and Hard Rock Casino Northern Indiana revenues from 2021 and 2022 because of the MSC closure and Hard Rock opening and dark period between the Majestic Star closure and Hard Rock debut), then the only change in ranking came from Ameristar Casino East Chicago falling by two rungs on the leader ladder from third to fifth place.

Last year, 2023, saw much more volatility, but no casino rose or fell by more than one rung on the ladder. Horseshoe Indianapolis grew one spot to second. Caesars Southern Indiana improved by one to fourth, and Bally’s Evansville bumped up one slot to seventh. Losing position: Horseshoe Casino Hammond, which dropped by one to third, Harrah’s Hoosier Park, beset by renovation frustrations, slipped by one to fifth and Hollywood Casino Lawrenceburg was off by one to eighth place. Six properties held serve over the year.

During the first six months of 2024, eliminating Terre Haute from consideration, every property maintained its respective place relative to January – June 2023, suggesting the changing of

the guard is settling out and that Terre Haute’s new entry isn’t cannibalizing the already-existing properties.

The first half of 2019 delivered only two months above $190 million in statewide revenues, the fewest in any first half since 2015. Conversely, the first halves of 2021, 2022, and 2023 produced only two months with revenue south of $200 million . . . although of concern last year at this point was that in 2023, both of those months were the final two months of the first half, a back-to-back phenomenon that we had not seen since 2019.

Three of the six months of 2024 to date have fallen shy of $200 million in revenue, and one of those three was the most recent, June, which was the first full month of operation at full strength in Terre Haute (both the casino and hotel up and running for the entire month).

One difference from the last two years: From April – June – each month of the second quarter in 2022 and 2023 – we watched revenues decline progressively in each month. That was not unique historically; in seven of the 13 years after 2010, revenues have followed the same progressive shortfall pattern. But in only three of those seven years did year-end revenues lagged the prior full-year win. In 2024, win grew from April to May (not unexpected given that April offered only a partial month of gaming in Terre Haute). However, the decline from May to June 2024 was significant, off by $15.379 million (- 7.15%).

The Lake Michigan casinos assemble combined first-half 2024 win of $508,879,159, down by a hefty $29,785,898 (- 5.40%) from $537,665,057 in the same period in 2023, and ff from $563,121,366 in 2022 (though up from $492.75 million in the first half of 2021 which cobbled together about 3½ months of gaming at the two Majestic Star Casino boats before they permanently closed down in mid-April, offering a full month of no operating casino in Gary prior to the mid-May 2021 debut of Hard Rock Casino Northern Indiana, which carried the Gary banner through the end of Q2).

The Caesars Entertainment, Inc. Central Indiana casino couple ropes in $283,055,437 from January through June, down by $11,456,926 (- 3.89%) from $294,512,363 in 2023, but also off from $297,177,671 in the first half of 2022. The 2024 numbers come even with fully renovated casinos at both properties for all of the first six months of 2024.

The Indianapolis-area properties account for 23.25% of the 2024 first-half win, down from 23.91% in the prior year, from 23.50% in 2022, and from 24.3% of overall state win in 2021. The racinos had been responsible for 23% of the (pre-Hard Rock) Indiana market in their last January-June without live table games.

Unsurprisingly, Hard Rock in Gary again enjoys the most lucrative January – June in the state – a total of $228,013,344, up by $11,580,635 (5.35%) from $216,432,709 in the same six months of 2023, better than its $207,882,833 one year earlier and topping the Horseshoe Casino Hammond haul of $205.37 million in the first half of 2021 (Hard Rock debuted in May 2021). This was the best first half for any casino since the Hammond property 11 years back, in 2013, when that property generated more than $250 million during the year’s first half.

Recall that before Hard Rock entered the market in the second quarter of 2021, no casino had topped $200 million in the first half of the pandemic-affected 2019 or 2020 . . . after at least one property having done so since 2002 (when there was one fewer casino and no racinos). Indeed, as recently as 2010-12, two properties topped $200 million in January through June of each of those years.

After 2022 saw us return to having six properties account for at least $100 million in revenue during the first half of the year, something we had not seen since 2014, we slipped back to just five in 2023 (with Ameristar Casino East Chicago falling less than $1 million shy of the $1900 million mark last year). Five properties had also posted first-half win in each year since 2009 . . . until the pandemic.

During 2024, we stayed at five properties generating at least $100 million in first-half revenue, but Ameristar fell further from that mark this year.

While almost every quarter – and certainly every six-month period – has its own rhythm and distinct characteristics that make it differ from another, the first half of 2021 was unique in that casinos were still operating for several months under state mask, physical distancing, and capacity restrictions that affected how many table game positions and slot machines were open. That morphed into a looser patchwork of local restrictions, but both were tempered by more money in the pocket of patrons through federal stimulus checks, what seemed to be a booming economy, and if not a post-pandemic wanderlust, than certainly a pent-up demand to haul bodies out of Hoosier households for some entertainment options that had been foregone for far too many months . . . and casinos were among the few such choices for consumers, given movie theaters and concert venues were still shuttered, and professional sports were not yet back to anything approaching full public attendance.

The first half of 2021 was also impacted by the closure of the Buffington Harbor casinos and the debut of the nearby Hard Rock Casino Northern Indiana . . . following a brief dark period in Gary.

As everything appeared poised to smooth out in the first half of 2022 and return to a “normal pattern,” we were slammed by inflation (featuring high gas prices) and general economic uncertainty that seemed to impact consumer confidence . . . even as some Hoosiers benefited from the $125 per person taxpayer rebate reaching them in the second quarter.

In 2023, sports wagering changes in Illinois and the debut of sports wagering in Ohio no doubt cost Indiana casinos some foot traffic, and high gas and grocery prices may have also cut into discretionary spending on entertainment. Additional historical horse racing options in Northern Kentucky, Louisville, and astride Evansville also likely ate into first-half Hoosier revenues, but GMs should have had no complaint about mother nature compared to prior winters. And while Hoosier Park expansion disruptions may have discouraged some patrons, that was likely set off against the completed upgrades at its sister Horseshoe Indianapolis property.

On the negative side . . . the 2024 first half featured changes in sports wagering and historical horse racing options in Kentucky that were not in place in the first quarter of 2023, as well as inflation that arguably impacted discretionary consumer spending. Looking toward the positive, the first half of 2024 opened with Hoosier Park casino floor renovations in place, and the Terre Haute Casino Resort debuted in early April, followed by its mid-May hotel grand opening.

There may be too many uncertainties overhanging the Indiana economy today to make any projections for year-end revenues this year. As Niels Bohr, a Nobel laureate in physics and father of the atomic model – you saw him featured in Oppenheimer last year – once observed, “Prediction is very difficult, especially if it’s about the future.”

We’ll once again take our cue from him and shy away from venturing any suggestions about just what to expect by the end of December . . . but will simply note that the last time that the first half of a year was down by a comparable percentage (- 1.0% in 2010 and 2015) those two full years respectively ended down only modestly over the prior year, (- 0.1% and – 0.8% respectively).

Yet we live in different times, and when the first-half revenues were down by 2.6% last year, we looked back at the 2.5% first-half decline in 2019 and noted that full-year figures back then had only fallen off by 1.6% (though that year saw a more typical second half after being battered by the forces of nature in the first six months), and 2023 ended up falling by 3.6% over the full year of 2022, more than we had anticipated (we suggested the state would probably be looking closer to a two percent decline, perhaps offset a bit by the second-half opening of the renovated facility in Anderson . . . a reno effort that, in our defense, ran a few months late).

Revenues for the first half 2023 ended up being 50.94% of the 2023 full-year total, and we’re starting to see some of the same trend lines emerge. One phenomenon we will be watching is how the free play deductions will be used. In the second half of 2023, each of the final four months of the half saw a greater amount of free play credit taken than in the comparable month of 2022.